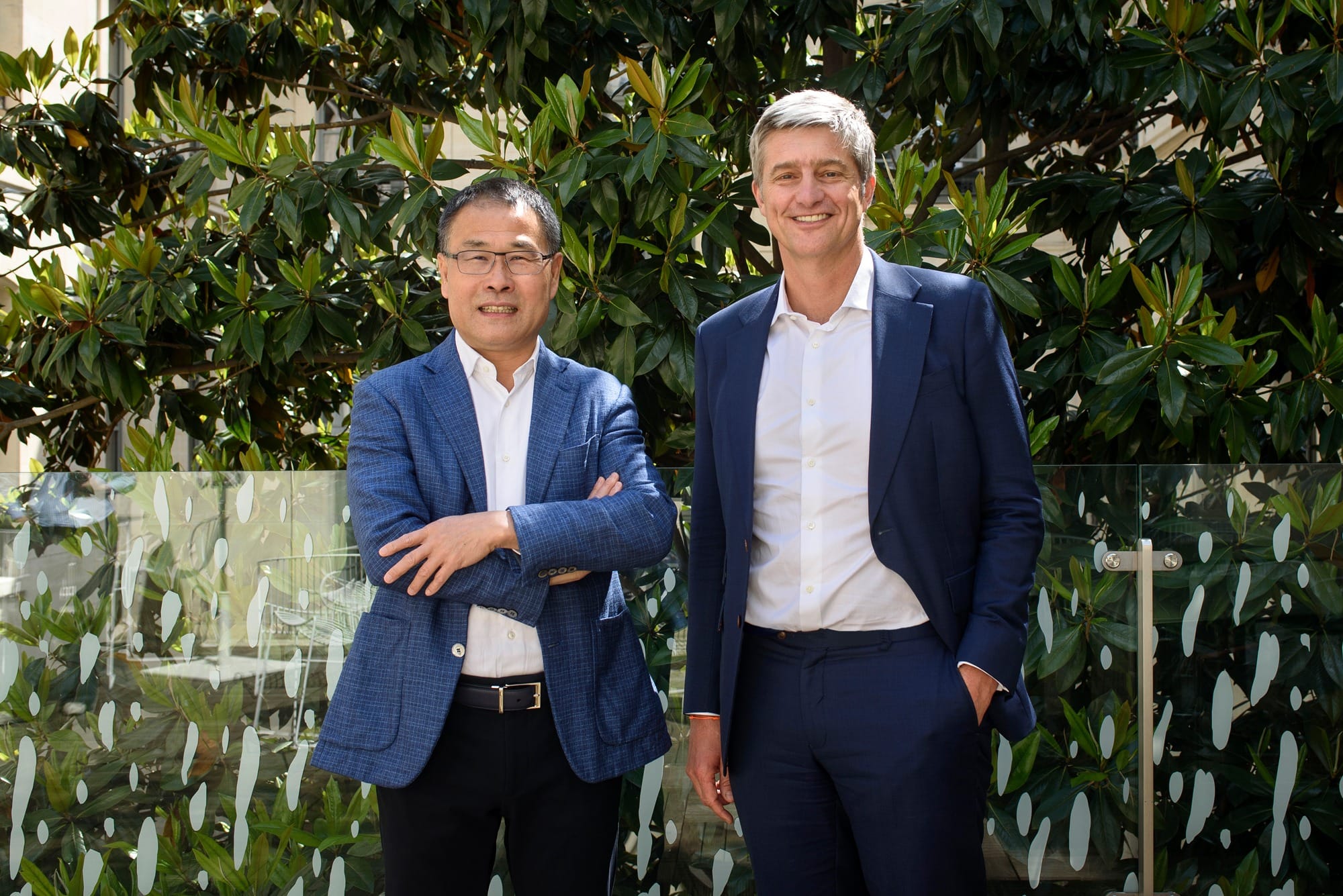

VinaCapital Vietnam Opportunity Fund (VOF), the London-listed closed-end fund managed by VinaCapital, announced on June 9 that it has sold one of its top five holdings, its stake in Tam Tri Medical JSC (TTMC), Vietnam’s leading private healthcare network, to a dedicated healthcare private equity firm based in South and Southeast Asia.

VOF invested in TTMC in 2018 as a private equity investment when the healthcare group operated four hospitals with approximately 400 beds, spread equally across the platform. Over the past six years, the VinaCapital investment team has worked alongside TTMC’s leadership to support them in the acquisition of three additional hospitals and commence development of a flagship greenfield hospital. This expansion has the potential to triple its number of operational beds and employees. Today, the platform serves over one million patient visits and 20,000 surgical cases annually.

Nguyen Huu Tung, founder of TTMC, commented, “VinaCapital has been instrumental to Tam Tri’s growth, especially during the unprecedented circumstances created by the pandemic, and I would like to thank the team for their tireless support and advice in helping to navigate that challenging situation and emerge even stronger. We believe the involvement of our new investor at this pivotal time will accelerate TTMC’s next phase of development and give more Vietnamese people access to affordable, high-quality healthcare.”

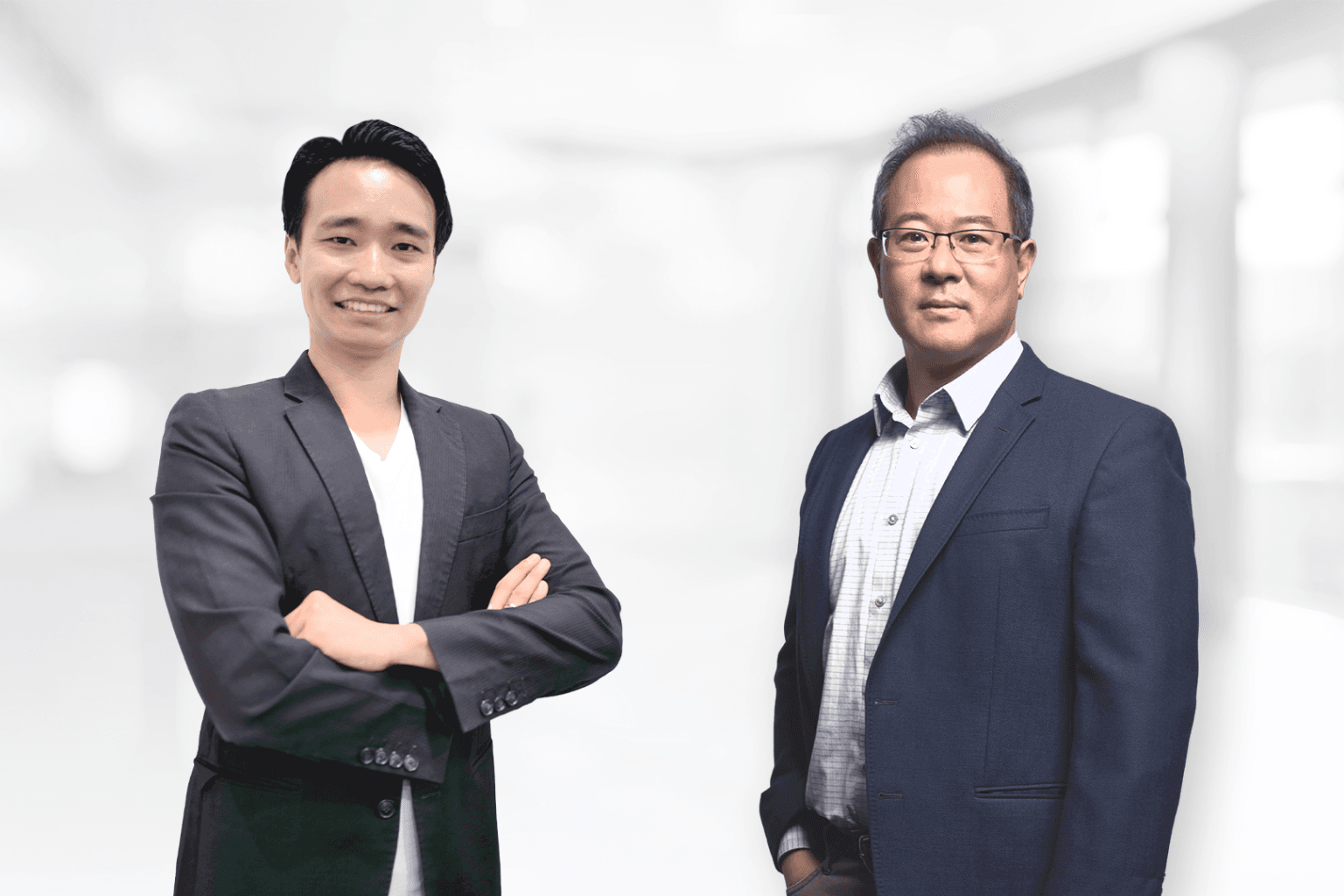

Khanh Vu, lead portfolio Manager of VOF, stated, “We’re privileged to have played a key role in Tam Tri’s growth. Our private equity team supported the TTMC team throughout the investment, particularly during COVID-19 and the challenges it presented, through to a phase of growth and expansion where we helped execute a series of hospital acquisitions to the original platform, to create one of the leading healthcare networks covering Vietnam’s central and southern regions. We would like to congratulate Dr Tung and his team as the company enters the next chapter of its evolution as Vietnam’s leading private healthcare network.”

Vu continued, “The successful divestment of our stake in Tam Tri Medical is notable for several reasons. First, we sold our stake at a premium to one of the region’s foremost healthcare investors who understand the market and its enormous potential. This exit is possible, despite difficulties to global macro conditions and the private equity deal landscape. Second, this private equity investment is a prime example of how we can create value as active investors with a significant minority stake, collaborating closely with sponsors to help them expand their businesses through licensing, capital management, restructuring, and mergers and acquisitions. Finally, the divestment of a top portfolio holding frees up capital, allowing us to deploy to other potential investments our team are evaluating.”

“Although the global economy remains uncertain, Vietnam continues to offer a range of compelling investment opportunities, particularly now that the development of the private sector is a government priority. As a longtime investor in Vietnamese companies, VinaCapital is excited to participate in this critical initiative,” Vu added.

Source: Vietnam Investment Review